inheritance tax on real estate nc

Inheritance tax on real estate nc Saturday February 26 2022 Edit. Seniors like other property owners pay capital gains tax on the sale of real.

Wholesale Opportunity In Reidsville Nc We Buy Houses Flipping Houses Home Buying

Are You Inheriting Real Property In NCCall 202 826-8179 or You may fill out the form below to get a quick fair cash offer on the property and a fast response.

. Prior to 2013 the state did have an estate tax but it was repealed in July 2013. Both inheritance and estate taxes are called death taxes. Items included in the.

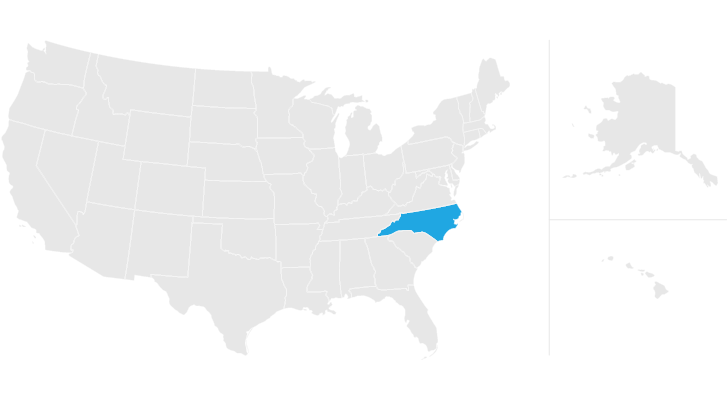

If someone dies in north carolina with less. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

North carolina inheritance tax and gift tax there is no inheritance tax in north carolina. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in 2018. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

As in other states the legal process of dealing with a decedents estate in North Carolina is known. Skip to main content Menu. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. North Carolina Department of Revenue. Home File Pay.

4 Does North Carolina have an estate tax or inheritance tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing. If you have been disinherited in North Carolina understanding NC inheritance laws is crucial to ensure that your rights are protectedFind out everything you need to know here.

The deceased persons estate must be managed and dispersed in accordance with their will. The inheritance tax is the tax charged to a person that receives an inheritance and it is that person that needs to file a tax return to report what was received. As in other states the legal process of dealing with a decedents estate in North Carolina is known.

Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. There is no federal inheritance tax but there is a federal estate tax. A surviving spouse is the only person exempt from paying this tax.

There is no inheritance tax in North Carolina. Tax Bulletins Directives Important Notices. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

For Tax Year 2019 For Tax. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

How To Settle Sibling Disagreements And Make Better Decisions On Selling An Inherited Home Check This Out Inheritinghometips Sale House Home Selling House

What Is A Step Up In Basis Cost Basis Of Inherited Assets

How To Avoid Estate Taxes With A Trust

401 K Inheritance Tax Rules Estate Planning

Many Parents Choose To Will Their Property Equally To All Their Children Leaving The Kids To Decide How To Divide E Inheritance Things To Sell Estate Planning

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Can I Mitigate My Children Paying Taxes On My Estate In Raleigh When I M Gone

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Education Real Estate

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

How To Sell An Inherited Home Wholesale Real Estate Real Estate Buying Real Estate Articles

Federal Gift Tax Vs California Inheritance Tax

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax And Who Pays It Credit Karma Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

Sell Your House North Carolina Selling House Sell House Fast Sell Your House Fast