how does hawaii tax capital gains

Taxes in Hawaii Hawaii Tax Rates Collections and Burdens. Long term capital gains are taxed at a maximum of 725.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Individual Income Tax Chapter 235 On net incomes of individual taxpayers.

. Hawaii Income Tax Calculator 2021. Hawaii also has a 440 to 640 percent corporate income tax rate. Other factors in determining gain are.

Hawaii tax forms are sourced from the. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status. Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386. General coverage of federal laws that are relevant to Hawaii income. States That Tax Capital Gains.

The difference between how much is withheld and how much is owed is the amount of your refund. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii. You do this by filing a non resident Hawaii.

If your taxable gains come from selling qualified small business stock section 1202 your capital gains tax rate is a maximum of 28. Digest of Tax Measures. 7 hours agoThe special rates are maximum rates.

If you sell collectibles art coins etc your capital gains tax rate is a maximum of 28. In cases where you paid all of your GE TA and capital gains taxes owed to Hawaii and the income tax owned to Hawaii on computed capital gains are less than the amount withheld you can file for a refund of the HARPTA withholding. The rates listed below are for 2022 which are taxes youll file in 2023.

Ad Track Clients Potential Tax Liability with Tax Evaluator. Hawaii has a graduated individual income tax with rates ranging from 140 percent to 1100 percent. Includes short and long-term Federal and State.

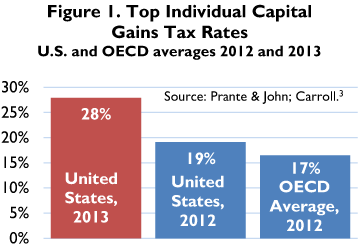

How does Hawaiis tax code compare. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which increases the tax rate by 118 percent. The amount withhel d is an estimated income tax payment and is claimed on the Hawaii income tax return that the seller must file for the year of sale.

A majority of US. Itemized deductions generally follow federal law. What is the actual Hawaii capital gains tax.

The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. This can help you reduce capital gain and. The Hawaii capital gains tax on real estate is 725.

If your ordinary tax rate is lower than the special rate ie either 10 12 22 or 24 your ordinary tax rate may apply to gain on qualified small. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015. Some States Have Tax Preferences for Capital Gains.

2016REV 2016 To be filed with Form N-35 Name Federal Employer ID. In Hawaii real estate generates 7 percent capital gains tax. The state of Hawaii will keep your money if you do.

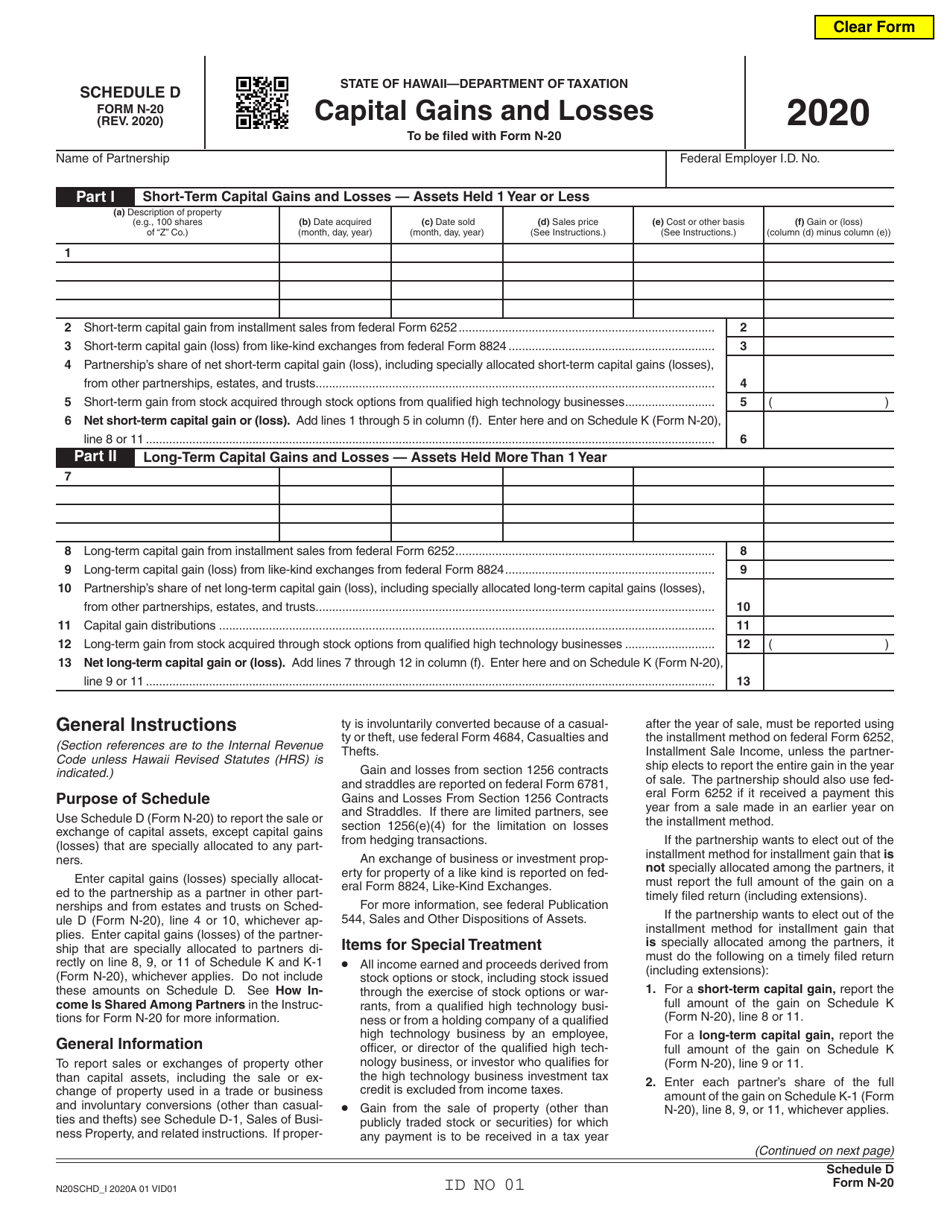

After the tax is withheld and Form N -288 is filed the Department notifies the seller that the amount withheld has been received. There are many exceptions to capital gains made. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains.

Additional State Income Tax Information for Hawaii. The Hawaii capital gains tax on real estate is 725. Hawaii taxes capital gains at a lower rate than ordinary income.

Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. The highest-income taxpayers pay 408 percent on income from work but only 238. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Hawaii taxes gain realized on the sale of real estate at 725. States have an additional capital gains tax rate between 29 and 133. This applies to all four factors of gain refer below for a discussion of the four factors.

Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 405 KB Revised July 2022 Tax Brochures Tax Law and Rules Tax Information Releases TIRs. Tax loss harvesting is a strategy that can help you make the most of your investment losses by turning them into tax offsets and hence less tax bill. PART I Short-Term Capital Gains and Losses Assets Held One Year or Less a.

Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased. Your average tax rate is 1198 and your marginal tax rate is 22. The federal government taxes income generated by wealth such as capital gains at lower rates than wages and salaries from work.

1031 Exchange Hawaii Capital Gains Tax Rate 2022

In A Blow To Progressives Douglas County Court Strikes Down Wa S New Capital Gains Tax The Seattle Times

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Form N 20 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Hawaii Templateroller

Individual Income Taxes Urban Institute

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

Crypto Capital Gains And Tax Rates 2022

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

How High Are Capital Gains Taxes In Your State Tax Foundation

Budgetary Treatment Of Capital Gains

Hawaii Income Tax Hi State Tax Calculator Community Tax

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

2022 Capital Gains Tax Rates By State Smartasset

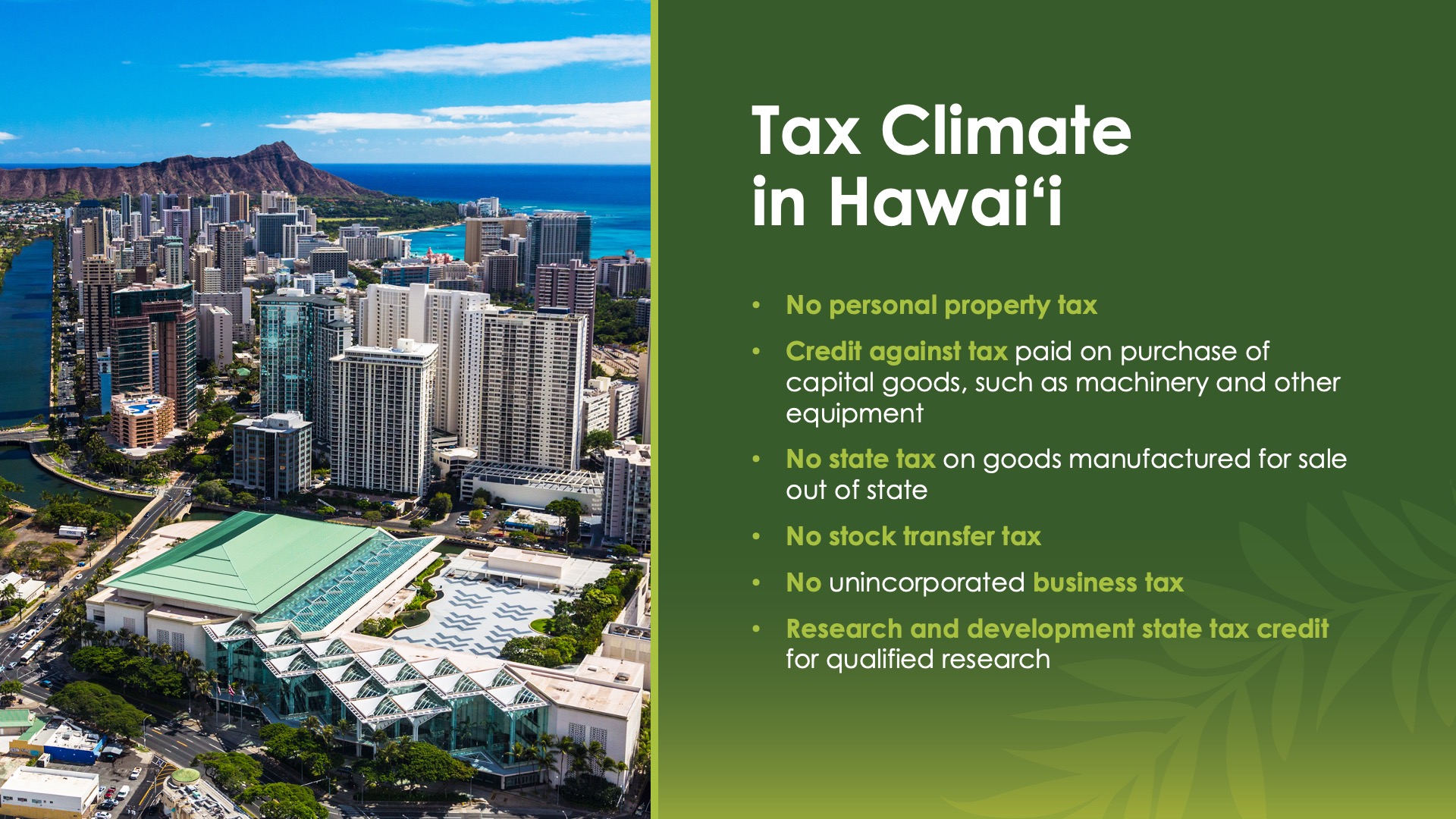

Business Development And Support Division Tax Incentives And Credits

2021 2022 Long Term Capital Gains Tax Rates Bankrate

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition